×

Please verify

Each day we overwhelm your brains with the content you've come to love from the Louder with Crowder Dot Com website.

But Facebook is...you know, Facebook. Their algorithm hides our ranting and raving as best it can. The best way to stick it to Zuckerface?

Sign up for the LWC News Blast! Get your favorite right-wing commentary delivered directly to your inbox!

EconomyApril 14, 2023

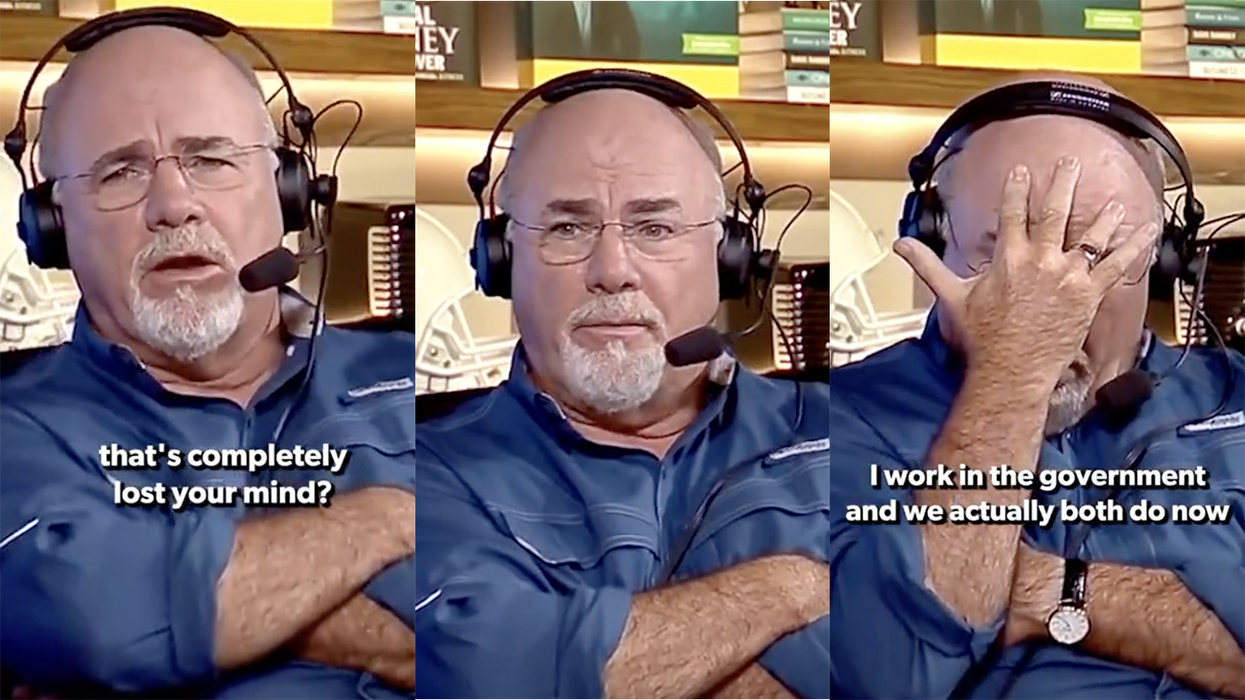

Watch: Dave Ramsey's reaction to a 29-year-old government employee racking up $1 MILLION in debt is all of us

Dave Ramsey wants you to be debt free. It's a simple equation, albeit one not all of us follow. You can't spend more than you bring in, and if you are...stop. Ramsey may have met his match and went viral on Thursday reacting to a 29-year-old government employee who is a million dollars in debt.

Yes, a million dollars. Yes, she's 29 (her husband is 32). And yes, they are both government employees.

This is absolutely INSANE holy mother of god pic.twitter.com/HskGvE3qex

— ACE CRISTIAN JAVIER 🇵🇷 (@sportynory) April 11, 2023

The highlights:

- Mortgage: $210,000

- Student loans: $335,000

- Credit Cards: $136,000

- Personal Loans: $44,000

- Car Loans: $35,000

Set aside the mortgage. Without knowing specifics, I've always felt a house was a better investment than renting. Plus depending on where you live and the deal you got, a mortgage payment could be equal to or even less than what you would pay in monthly rent.

Let's focus on student loans since there is a debate about the government bailing out people like this, and people like this are why so many Americans OPPOSE the government bailing out student loans. If you have $335k in student loans, you shouldn't have ANY car loan debt. You should be driving a used car. Correction: you should be SHARING a used car. And call it a hunch, I doubt it's $136k of necessities they racked up on their credit cards.

But it's the $335K for an ADVANCED DEGREE in POLICY for a GOVERNMENT EMPLOYEE that sticks with me. It's like a walking embodiment of *waves hands* the entire debate against middle-class taxpayers bailing student loans:

- Most student loan debt is held by people who have master's degrees or higher. Either 56% or close to 60% of student loan debt is held by people with master's degrees. It depends on if you believe Politifact or Ron DeSantis' spokeswoman quoting Politifact.

- Congresswomen most vocal about student loan forgiveness want their student loans forgiven. Congresswoman Ilhan Omar. Congresswoman Rashida Tlaib. Social media influencer Rep. AOC. They all make close to $200k a year, yet say they can't pay off their student loans.

- Joe Biden's White House aides hold a combined total of $4.7 million in student loan debt. Per Bloomberg, "at least 30 senior White House staffers have student loan balances, according to 2021 financial disclosures Bloomberg News obtained from the Office of Government Ethics, including Biden’s new press secretary, Karine Jean-Pierre, and Bharat Ramamurti, deputy director of the National Economic Council." One legislative aide owes "between $500,000 and $1 million." No word on if it's the deputy director of the National Economic Council, whose job it is to advise Joe Biden on economic issues.

I suppose the couple gets credit for wanting to pay their MILLION DOLLARS IN DEBT down and do so without bankruptcy. I just don't know how.

><><><><><><

Brodigan is Grand Poobah of this here website and when he isn't writing words about things enjoys day drinking, pro-wrestling, and country music. You can find him on the Twitter too.

Facebook doesn't want you reading this post or any others lately. Their algorithm hides our stories and shenanigans as best it can. The best way to stick it to Zuckerface? Sign up for our DAILY EMAIL BLASTS! They can't stop us from delivering our content straight to your inbox. Yet.

From Your Site Articles

Latest