×

Please verify

Each day we overwhelm your brains with the content you've come to love from the Louder with Crowder Dot Com website.

But Facebook is...you know, Facebook. Their algorithm hides our ranting and raving as best it can. The best way to stick it to Zuckerface?

Sign up for the LWC News Blast! Get your favorite right-wing commentary delivered directly to your inbox!

FeaturedApril 05, 2021

SHOW NOTES: John Oliver's ABSURD National Debt Lies DEBUNKED!

John Oliver thinks he can get away with lying about Donald Trump and the national debt. We won't let him! Also, Charles Barkley made a common sense statement on race that pissed off liberal Twitter. Joe Biden was busted cheating during his press conference. And the truth about Pete Buttigieg and his bike.

'We are currently BANNED from YouTube. To watch today's episode, watch for free on our LIVE SHOW LINK! Use promo code FIGHTLIKEHELL for $20 off Mug Club!

DEBUNKING JOHN OLIVER'S NATIONAL DEBT SEGMENT

- John Oliver released a video on the national debt. SOURCE: YouTube

- CLAIM: The economy got worse under Trump's tax cuts.

- TRUTH: Social Security, Medicare, and Medicaid composed 46% of the 2019 federal budget. SOURCE: Manhattan Institute

- ⅓ of doctors don't accept new Medicaid patients. SOURCE: CDC

- SOCIAL SECURITY: Social security payments are set to run out in 2034. SOURCE: SSA

- There is not enough revenue to sustain the program.

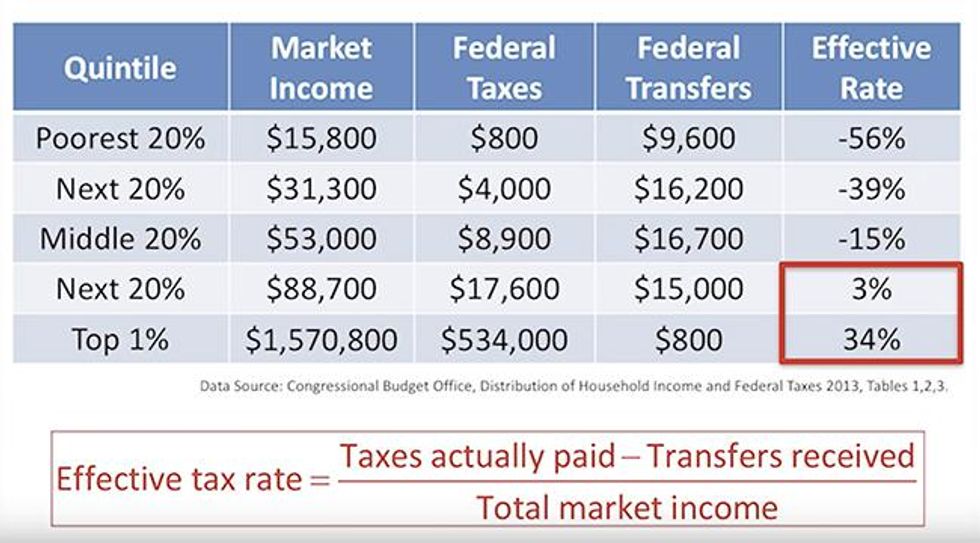

- And any tax cuts are marketed as "for the rich" because the rich are the only ones who pay net taxes.

- The rich will leave if taxed too much, and the bottom income earners will bear the brunt of the tax hike.

- The bottom 20% pay a net negative of 56%.

- In comparison, the top 1% pay 34%.

- CLAIM: "So long as the economy grows at a rate greater than the interest we pay on our debt, we come out ahead."

- TRUTH: Trump's economy grew by 3.5%. SOURCES: CNN, Politifact

- Obama's economy maxed out at 2.6% and ended at only 1.9% growth.

- CLAIM: Oliver and Dems claim the problem isn't excessive spending but lack of tax revenue.

- TRUTH: Despite top marginal income tax rates ranging from 90% under the New Deal to as low as 30%, tax revenue has consistently remained 17% as a percent of GDP with a deviation of only 1.2%! SOURCE: Political Calculations

- If you taxed all revenue over $1 million at 100%, you would only pay off about ⅓ of the deficit. SOURCE: Forbes

Get your content free from Big Tech's filter. Bookmark this website and sign up for our newsletter!

Latest