×

Please verify

Each day we overwhelm your brains with the content you've come to love from the Louder with Crowder Dot Com website.

But Facebook is...you know, Facebook. Their algorithm hides our ranting and raving as best it can. The best way to stick it to Zuckerface?

Sign up for the LWC News Blast! Get your favorite right-wing commentary delivered directly to your inbox!

EconomyApril 14, 2023

Watch: Media finally reports on IRS coming after your $600 side hustles, but leaves out an important fact

With tax day next week, the media is FINALLY getting around to reporting on Biden's IRS and their new tax law targeting your side hustles. We've been talking about it since last year. CBS News? They got around to it a few days ago.

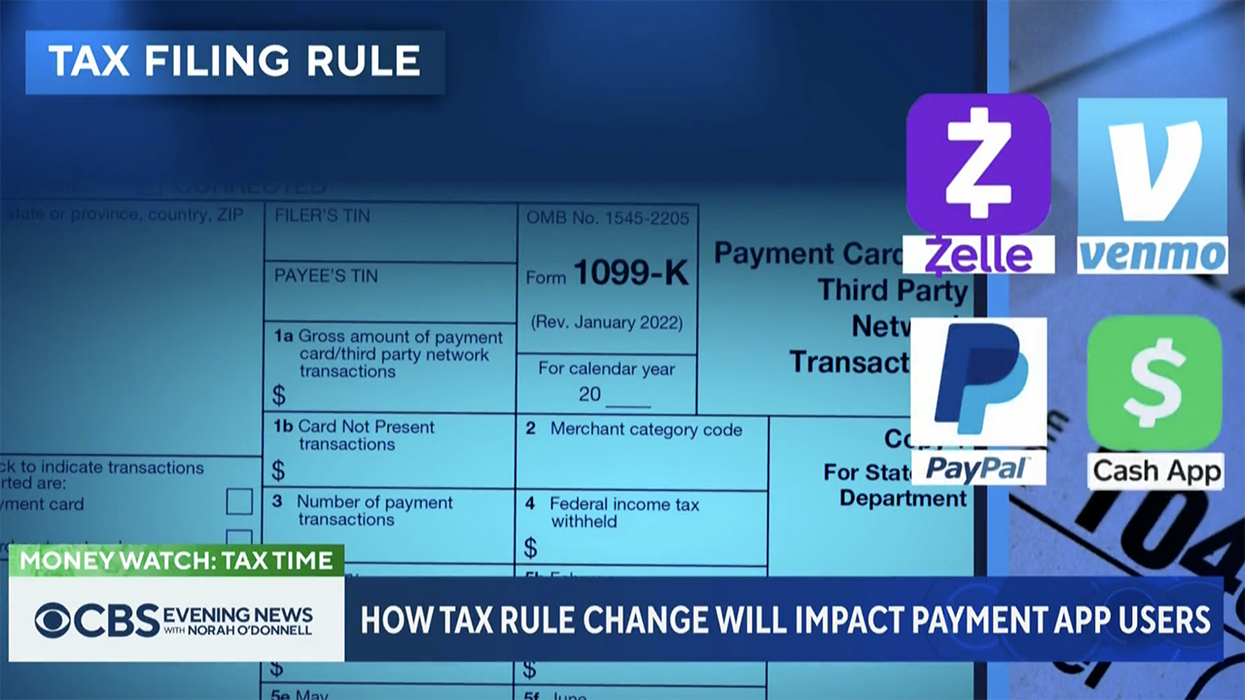

Starting next year, a new IRS rule will require anyone earning over $600 on payment apps, like Venmo, in 2023 to receive a 1099-K form. The old threshold was earning $20,000 over 200 transactions. pic.twitter.com/TaygGwFBep

— CBS Evening News (@CBSEveningNews) April 12, 2023

It used to be you would need to file a 1099-K if you made $20,000 dollars on the side with 200 transactions. The new tax rule is $600 dollars for every ONE transaction. Also, apps like Venmo and PayPal will report those $600 transactions directly to the IRS.

But CBS News left out a key detail. They said it is a new rule, but where did this new rule come from? It was snuck into Biden's American Rescue Plan. AKA, the stimulus bill. If your elected official voted for it, they voted to lower the threshold to $600. If your elected official is a Democrat, they voted for it.

By now you're saying to yourself, "But Brodigan, I'm not a millionaire or a billionaire. I was told that Biden looking to increase taxes on the middle class was misinformation. What the deuce?"

Millionaires and billionaires be warned. https://t.co/9BqrcGFA9S

— Randy Barnett (@RandyEBarnett) April 13, 2023

Two things. One, LOL... you said "butt Brodigan." B, I'm not a journalist or an expert. I'm not qualified to answer your question.

However, there are some things I find interesting that has happened over the past two years. Things that happened all under the guise of protecting the middle class during the, and resulting from, the pandemic. You might find them of interest yourself.

- Democrats snuck lowering the threshold to $600 in the American Rescue Plan Act of 2021. Critics called the bill "bribing us with our own money." If you opposed this part of the Biden agenda, you were told you didn't want to help taxpayers by sending them stimulus checks.

- Funding for 87,000 new IRS employees was snuck into the Inflation Reduction Act. If you opposed this part of the Democrat agenda you were told you didn't want to reduce inflation.

- PayPal, which is willing to work with the Administration, tried sneaking in a penalty that they will take up to $2500 out of your account over what they call "misinformation." Whether what they call "misinformation" is the same as what the Administration defines as "misinformation" is unclear. But I know that you know that I know that you know.

- The IRS didn't post an "explainer" about this new rule -- this new rule that was buried in "comprehensive legislation" -- until two weeks after Election Day 2022.

Now the media is reporting on it days before tax day 2023. This new rule that goes into effect on tax day 2024. If taxpayers/voters have a problem with it, there is no longer anything they can do until Election Day 2024, seven months after they get screwed by the IRS.

In a perfect world, one where there was an institution whose sole job was to hold our elected officials accountable, this new IRS rule would be reported on and exposed PRIOR to it being snuck into a ginormous piece of comprehensive legislation no one was allowed to read.

Instead, that institution was too busy fluffing the President and the elitists who demanded the law passed to care about anyone else in America.

><><><><><><

Brodigan is Grand Poobah of this here website and when he isn't writing words about things enjoys day drinking, pro-wrestling, and country music. You can find him on the Twitter too.

Facebook doesn't want you reading this post or any others lately. Their algorithm hides our stories and shenanigans as best it can. The best way to stick it to Zuckerface? Sign up for our DAILY EMAIL BLASTS! They can't stop us from delivering our content straight to your inbox. Yet.

From Your Site Articles

- Tim Pool releases new song with canceled drummer from legendary punk band, and it rocks ›

- Joe Biden Brain-Farts and Invents New Number: A Trillion Million Billion ›

- A broken-hearted Elon Musk reveals the reason why AOC will never date him ›

- Watch: Rep. AOC sets up camera to record her totally real and not at-all-contrived reaction to the World Cup ›

- Joe Biden's jive about paying "your fair share" gets fact-checked into oblivion when Elon Musk calls down the thunder ›

- 'All rocks are my friend': Lip reading 'expert' swears on God this is what AOC and Matt Gaetz were chatting about ›

- Watch: AOC gives her full support for exposing children to drag shows, claims cisgender men are the REAL problem ›

- Watch Today's Show - Louder With Crowder ›

- Elon Musk reveals Twitter code that sensor tweets - Louder With Crowder ›

- This Kid's First Paycheck Becomes His First Lesson on Taxes - Louder With Crowder ›

- Joe Biden admits truth about his Inflation Reduction Act - Louder With Crowder ›

Latest